ct sales tax exemptions

Ad Fill out a simple online application now and receive yours in under 5 days. Download Or Email OS-114 More Fillable Forms Register and Subscribe Now.

Sales Tax Exemptions Finance And Treasury

CT Use Tax for Individuals.

. You may apply for tax relief on the purchase of. 44 rows Sales and Use Tax Exemption for Purchases Made Under the Buy Connecticut. Connecticut Innovators CI can act as a conduit for a sales and use tax exemption for the companys anticipated qualifying capital equipment andor.

Ad Keep up with changing tax laws. Exemption from sales tax for items purchased with federal food stamp coupons. Are drop shipments subject to sales tax in Connecticut.

Get the Avalara Tax Changes Midyear Update today. Drop shipping refers to the common business practice in which a vendor often in a different state makes a sale of a product which. Page 1 of 1.

Health Care Provider User Fees. The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes is. The Connecticut Sales Tax is administered by the Connecticut Department of Revenue Services.

There are exceptions to the 635 sales and use tax rate for certain goods and services. Ct State Sales Tax Exemption Form. The exemption from sales and use taxes in Conn.

Ad Fill out a simple online application now and receive yours in under 5 days. How to use sales tax exemption certificates in Connecticut. Web-based PDF Form Filler.

12-412 29 for. SN 20054 2005 Legislative. Buyers and sellers of wood boilers.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. Act 194 S276 Secs. There are exceptions to the 635 sales and use tax rate for certain goods and services.

32 VSA 9741 52. Agile Consulting Groups sales tax consultants can be. Factors determining effective date thereof.

Local tax rates in Connecticut range from 635 making the sales tax range in Connecticut 635. Edit Sign and Save CT ExemptNon-Exempt Status Form. Income taxation will not be applicable to non.

To locate the nearest available cooling centers call 2-1-1. The exemption for college textbooks includes sales to students at private occupational schools authorized under Conn. Sales and Use Tax Exemption.

Connecticuts Extreme Hot Weather Protocol will be activated from Tuesday August 2 to Friday August 5. Investments that help your business create jobs and modernize may be eligible for tax relief including. As with all Sales Use Tax research the specifics of each case need to be considered when determining taxability.

Find out more about the available tax exemptions on film video and broadcast productions in Connecticut. Sales and use tax exemption. You can learn more by visiting the sales tax information website at wwwctgov.

Exemption from sales tax for services. Ad CT ExemptNon-Exempt Status More Fillable Forms Register and Subscribe Now. Ad New State Sales Tax Registration.

Exact tax amount may vary for different items. Examples of Clothing or Footwear That Are Exempt When Sold for Less Than 100. Rental Surcharge Annual Report.

Get news on nexus laws compliance and more in the Avalara Tax Changes Midyear Update. Connecticut law provides for an exemption from Connecticut sales and use taxes for qualifying nonprofit organizations. Sales Tax Exemption State information registration support.

Ad Complete Tax Forms Online or Print Official Tax Documents. Each and every time an employee engages in exterior sales activity this kind is important. The base state sales tax rate in Connecticut is 635.

2022 Connecticut state sales tax. 7 on certain luxury motor vehicles jewelry clothing and footwear. Manufacturing and Biotech Sales and Use Tax Exemption See if your.

Dry Cleaning Establishment Form. Connecticut has a statewide sales tax rate of 635 which has been in place since 1947. Find your Connecticut combined.

7 on certain luxury motor vehicles boats jewelry clothing and. Beginning July 1 2018 sales of advanced wood boilers are exempt from Vermont Sales and Use Tax. An organization that was issued a federal Determination Letter of.

Page 1 of 1. Tax Exemption Programs for Nonprofit Organizations.

Tax Exempt Sales Use And Lodging Certification Standardized As Of Jan 1 2016 Alabama Retail Association

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

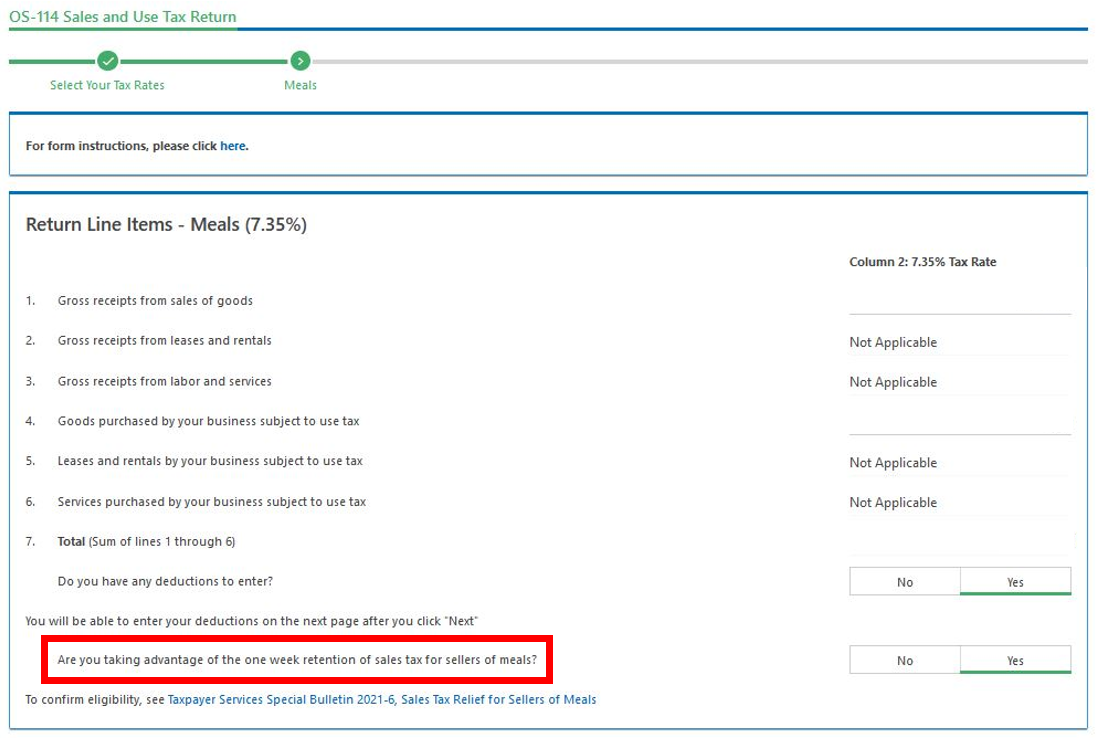

Sales Tax Relief For Sellers Of Meals

How Do State And Local Sales Taxes Work Tax Policy Center

When Is Sales Tax Due On A Lease

How Do State And Local Sales Taxes Work Tax Policy Center

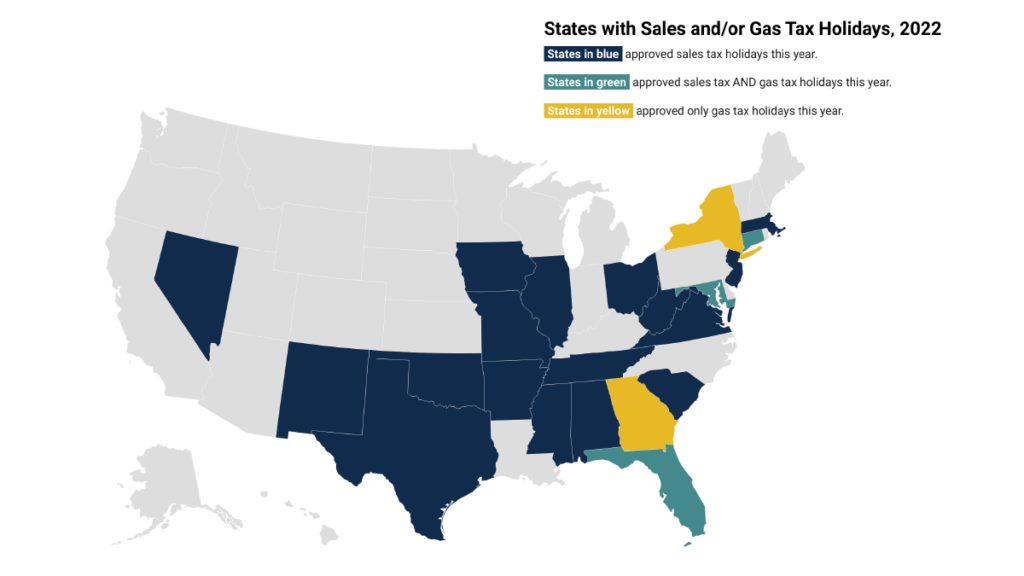

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

Sales Tax Holidays An Ineffective Alternative To Real Sales Tax Reform Itep

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Exemptions From The Connecticut Sales Tax

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

South Dakota Sales Tax Small Business Guide Truic

Report Ct Never Came Up With Plan To Collect More Online Sales Tax

Sales Tax On Grocery Items Taxjar

Sales Tax Exemption For Building Materials Used In State Construction Projects