maryland digital advertising tax proposed regulations

On August 31 2021 the Maryland Comptroller filed proposed regulations on the controversial digital advertising gross revenues tax the DAT with the Joint Committee on. On December 3 Maryland Comptroller Peter Franchot issued final regulations for the nations first digital advertising tax.

States Are Imposing A Netflix And Spotify Tax To Raise Money

In simple terms the proposed regulations would require companies that derive revenue from residents of Maryland as a direct result of those residents responding to digital ads running in.

. Digital Advertising Gross Revenues Tax Persons with global annual gross revenues equal to or greater than 100000000 must pay a tax on the portion of those. The digital advertising tax will be imposed at the following rates. Finally there are several proposals in Massachusetts.

On December 3 2021 the Maryland Comptroller published notice of its adoption of the digital advertising gross revenues tax regulations which was originally proposed on. Effective on January 1 2022 the digital advertising tax is imposed on the annual gross revenues of a person derived from digital advertising services in Maryland. House Docket 3210 would impose tax on a taxpayer with at least 50 million in annual gross revenues and 100000 in.

The comptroller of Maryland is circulating proposed regulations that would provide guidance on the states new digital advertising tax. COVID-19 relief act provision that. The escalating rate scale works to exclude from the tax any entity with less than 1 million of gross revenues from digital advertising services in Maryland and 100 million in.

Law360 December 3 2021 724 PM EST -- The Maryland comptroller published final regulations Friday governing the states first-in-the-nation digital ad tax that. 25 of the assessable base for persons with global annual gross revenues of 100 million through 1. The states digital advertising tax and its regulations.

Marylands new digital advertising tax is targeting online and digital advertisements stemming from the significant growth and popularity of social media the. On August 30 the Maryland comptroller filed proposed regulations with the states Joint Committee on Administrative Executive and Legislative Review to clarify how businesses. On December 3 2021 the Maryland Comptroller published notice of its adoption of the digital advertising gross revenues tax regulations which was originally proposed on.

The law establishes that. Entities with annual gross revenues from digital advertising services in Maryland of at least 1 million must file a return by April 15 of the following year.

The Fight Over Maryland S Digital Advertising Tax Part 1

Maryland Approves Country S First Tax On Big Tech S Ad Revenue The New York Times

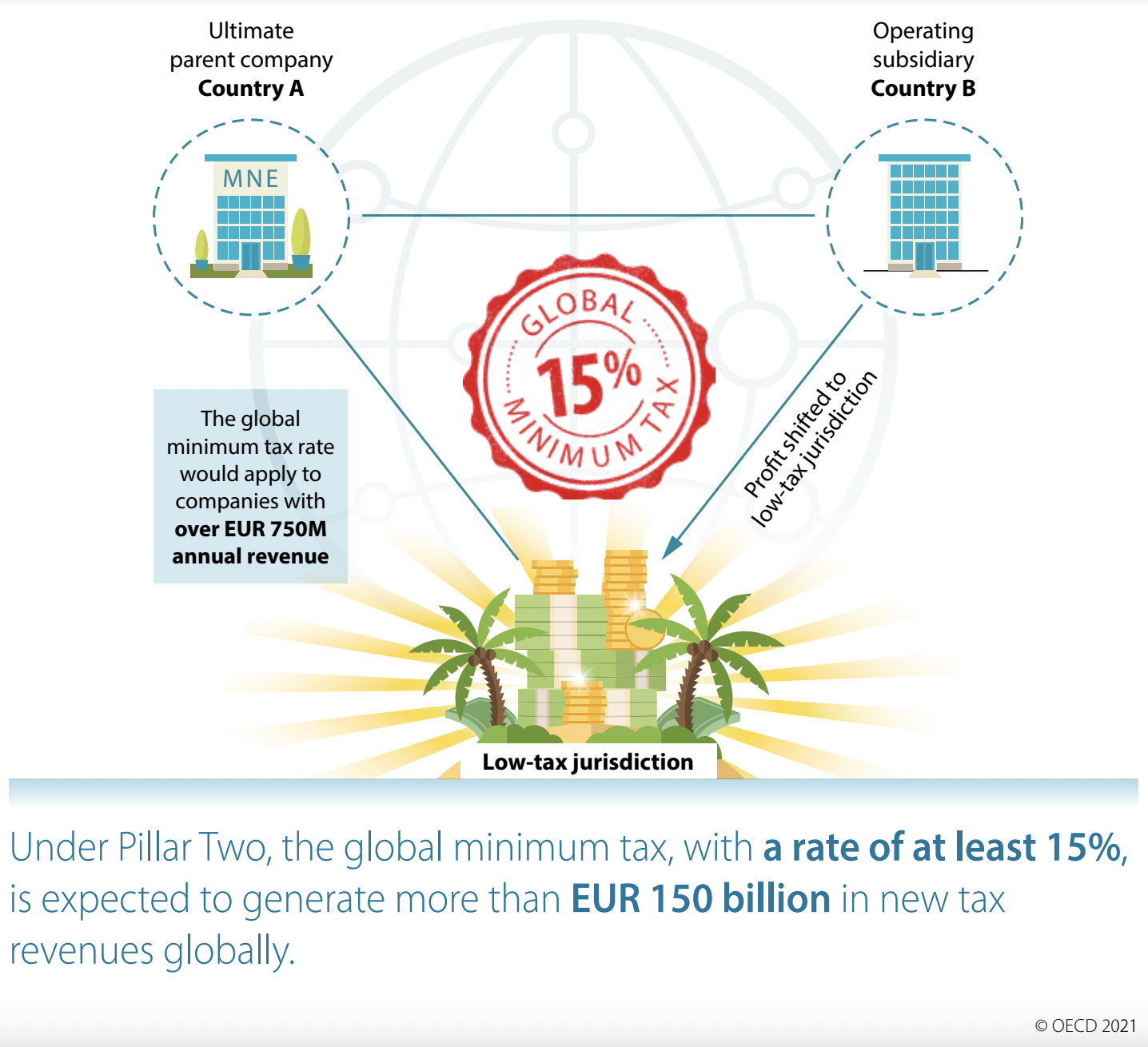

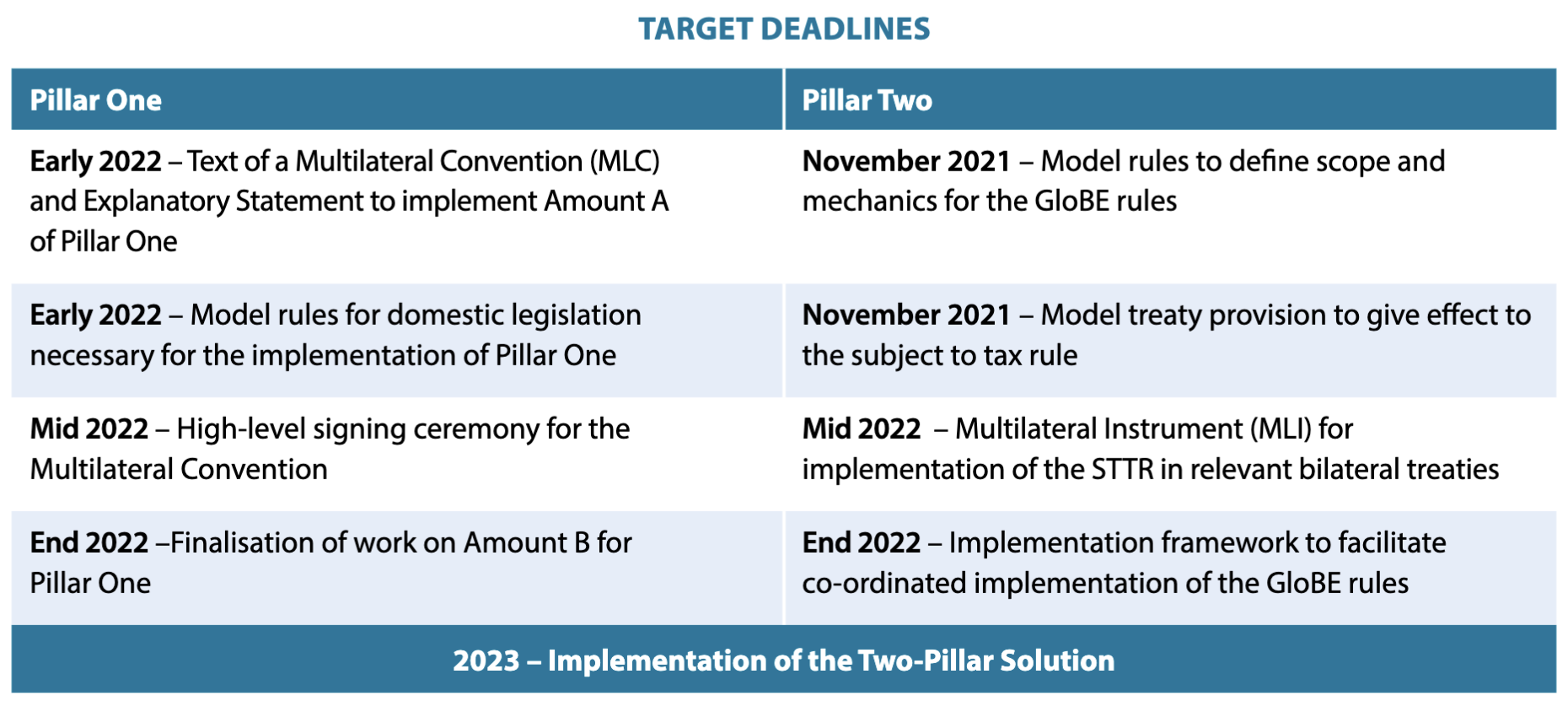

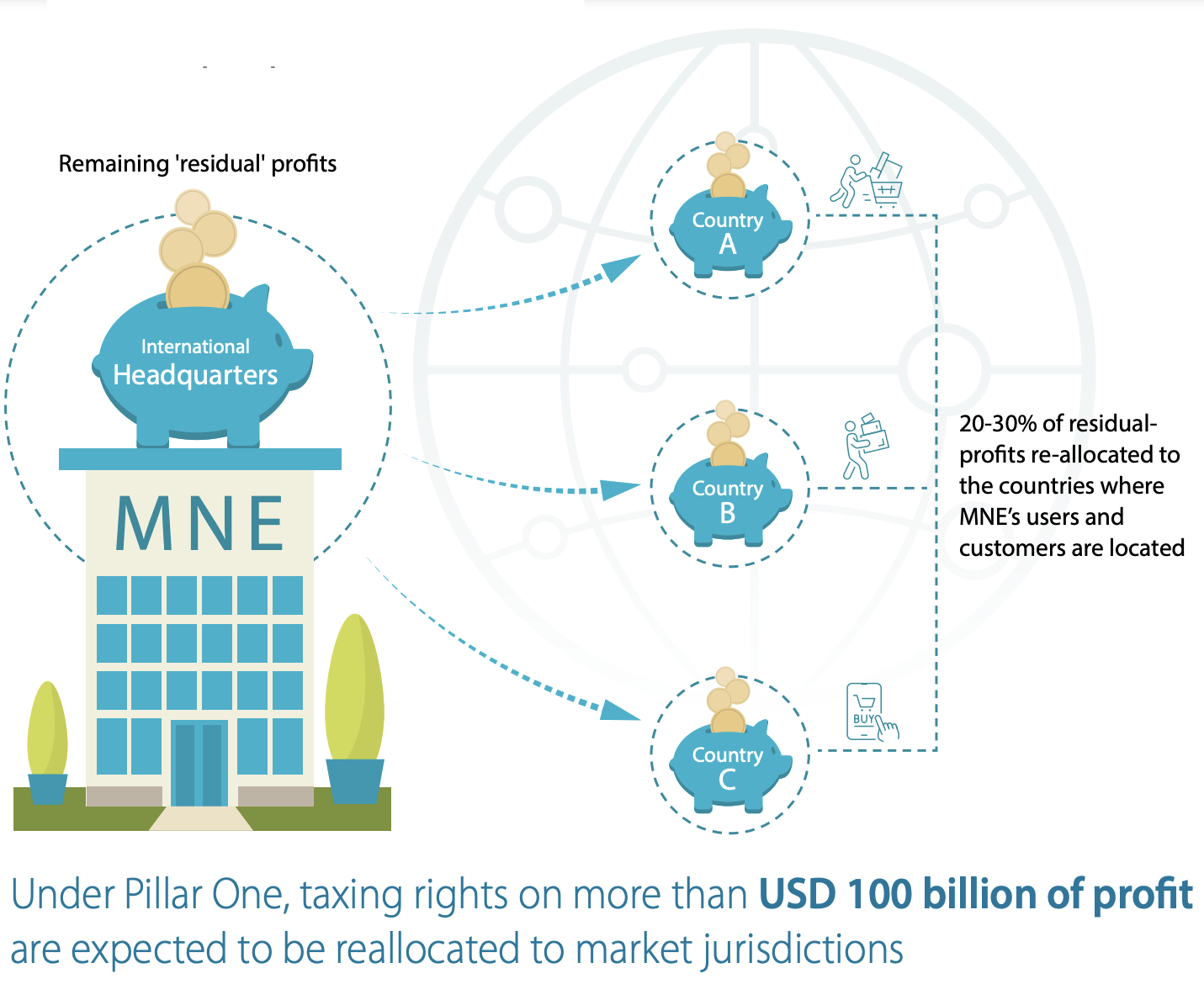

Digital Taxation In 2022 Digital Watch Observatory

Why Do We Care So Much About Privacy The New Yorker

Maryland Approves Country S First Tax On Big Tech S Ad Revenue The New York Times

Professional And Proven Marketing Proposals Free Samples Pdfs

Digital Taxation In 2022 Digital Watch Observatory

Digital Taxation In 2022 Digital Watch Observatory

Digital Taxation In 2022 Digital Watch Observatory

Interactive Advertising Bureau Public Policy Archives

The Fight Over Maryland S Digital Advertising Tax Part 1

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

Past Events C4e Centre For Ethics University Of Toronto

The Fight Over Maryland S Digital Advertising Tax Part 1

Interactive Advertising Bureau Public Policy Archives

Attacking The Black White Opportunity Gap That Comes From Residential Segregation

Digital Taxation In 2022 Digital Watch Observatory